UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨Preliminary Proxy Statement

SANDY SPRING BANCORP, INC.¨Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

(Name of Registrant as Specified in Its Charter)xDefinitive Proxy Statement

¨Definitive Additional Materials

¨Soliciting Material pursuant to §240.14a-12

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| SANDY SPRING BANCORP, INC. |

| (Name of Registrant as Specified in Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| ¨ | Fee paid previously with preliminary materials: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

NOTICE OF 2018 ANNUALSPECIAL MEETING OF SHAREHOLDERS TO BE HELD

Wednesday, April 25, 2018,November 18, 2020, 10:00 a.m.

Company HeadquartersVirtual Only - Willard H. Derrick Building

17801 Georgia Avenue, Olney, MD 20832www.meetingcenter.io/238391765

The 2018 annualboard of directors has called a special meeting of shareholders (“Special Meeting”) to request the approval of Sandy Spring Bancorp, Inc.,our Employee Stock Purchase Plan, as Amended and Restated. The Special Meeting will be conducted solely online via live webcast. You will be able to attend and participate in the Special Meeting online, vote your shares electronically by entering the control number on your proxy card, and submit your questions during the meeting by visiting: www.meetingcenter.io/238391765 at the date and time described in the accompanying proxy statement. The password for the meeting is SASR2020. There is no physical location for this Special Meeting.

The Special Meeting will be held as indicated above for the purpose of considering:

The board of directors established February 28, 2018,September 16, 2020, as the record date for this meeting. Shareholders of record as of the close of business on that date are entitled to receive this notice of meeting and vote their shares at the meeting and any adjournments or postponements of the meeting.

Your vote is very important.important. The board urges each shareholder to promptly signvote online, by phone, or by signing and returnreturning the enclosed proxy card or to use telephone or Internet voting, as described on the card. If you choose to attend the virtual meeting, you may withdraw your proxy and vote in person.online during the course of the meeting using the control number on your proxy card.

| By order of the board of directors, | |

| |

| Olney, MD | |

| October 7, 2020 | General Counsel & Secretary |

| This proxy statement is available at www.investorvote.com/sasr. | |

Important Notice Regarding the Availability of Proxy Materials for the

2018 Annual Meeting of Shareholders to be Held on April 25, 2018

This proxy statement and the 2017 Annual Report on Form 10-K are available at

www.envisionreports.com/sasr.

TABLE OF CONTENTS

Sandy Spring Bancorp, Inc.

Proxy Statement

The board of directors of Sandy Spring Bancorp, Inc., has furnished this proxy statement to you in connection with the solicitation of proxies to be used at the 2018 annualthis special meeting of shareholders (“annual meeting”Special Meeting”) or any postponement or adjournment of the meeting. The notice of annualspecial meeting is being first mailed on or about March 14, 2018October 7, 2020 to shareholders of record as of the close of business on the record date.September 16, 2020 (the “Record Date”). In this proxy statement, the “Company,” “Bancorp,” “we,” “our” or similar references mean Sandy Spring Bancorp, Inc., and its subsidiaries. The “board”“Bank” refers to Sandy Spring Bank. The “Board” refers to the board of directors of Sandy Spring Bancorp, Inc.

The Board is holding the Special Meeting in virtual format due to concerns over the coronavirus pandemic, which has elevated health safety concerns for our shareholders, making the virtual-only format a safe means for attending the Special Meeting.

The following is an overview of information described in more detail throughout this proxy statement. This is only a summary, and we encourage you to read the entire proxy statement carefully before voting. For complete information about

Please refer to your Notice of Internet Availability of Proxy Materials (“Notice”) for instructions on how to attend and participate in this virtual-only Special Meeting. You will need your control number on the Company’s performance, please review our 2017 Annual Report on Form 10-K.Notice or proxy card to register at the virtual meeting site.

| Date and Time: | Wednesday, | |

| Virtual meeting site: | www.meetingcenter.io/238391765 | |

| Record Date: | ||

Voting MattersMatter and Board RecommendationsRecommendation

| Proposal | Board Recommendation | More Information | |||

| |||||

| restated | “FOR” | Page | |||

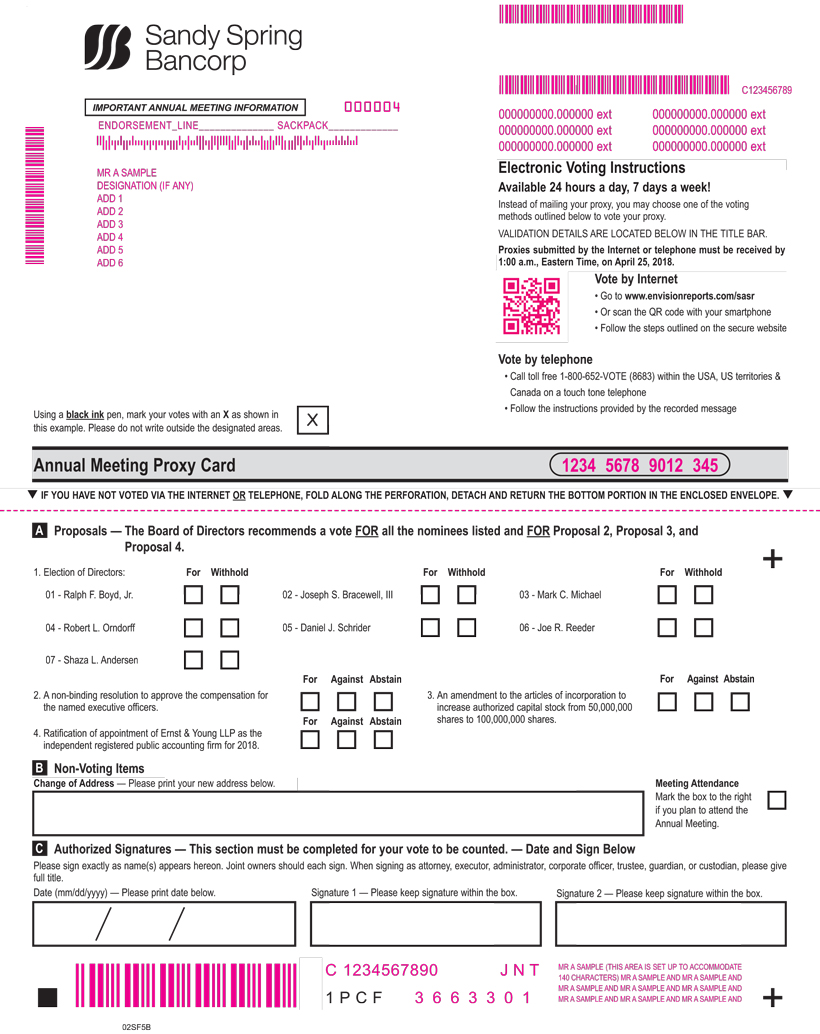

How To Cast Your Vote

Even if you plan to attend the annual meeting in person,Special Meeting, please cast your vote as promptly as possible by following the instructions on the Notice of Availability of Proxy Materials and the proxy voting card using:

| Internet | Telephone | |

|  |  |

Summary of Governance Practices

The Company is committed to governance practices that support our long-term strategy, demonstrate high levels of integrity, and earn the confidence of investors.

PROPOSAL 1: Election of Directors

The board is elected by the shareholders to represent their interest in the Company. With the exception of those matters reserved for shareholders, the board is the highest and ultimate decision-making authority. The board works closely with executive management and oversees the development and execution of our business strategy.

Board Complement

Our board currently has 15 members divided into three classes in equal number. In general, the term of only one class of directors expires each year, and the directors within that class are elected for a term of three years or until their successors are elected and qualified.

In connection with the acquisition of WashingtonFirst Bankshares, Inc., (“WashingtonFirst”) and the related merger of WashingtonFirst Bank into Sandy Spring Bank, the Company agreed to appoint four WashingtonFirst directors to the Company’s board. Upon completion of the acquisition on January 1, 2018, former WashingtonFirst Chairman Joseph S. Bracewell, former WashingtonFirst CEO and director Shaza L. Andersen, and WashingtonFirst directors Mark C. Michael and Joe R. Reeder joined the Company’s board. Also effective upon closing, director Susan D. Goff retired from the board after 23 years of dedicated service.

On December 13, 2017, the board of directors approved an amendment to the Company’s bylaws that permits a director to continue to serve on the board after the annual meeting of shareholders immediately following his or her seventy-second (72nd) birthday if (i) he or she was appointed to the board of directors in connection with a corporate acquisition, consolidation, or merger and (ii) the Nominating Committee and board of directors determine that his or her continued service would be of substantial benefit to the Company in recognizing the benefit of such acquisition, consolidation or merger. The board’s nomination of Mr. Bracewell (age 71) is made under this provision; and, if elected, Mr. Bracewell is expected to serve a complete term of three years.

Director-Nominees

A total of seven directors are nominated for election. Class I director-nominees are before you for election to a three-year term to expire in 2021: Ralph F. Boyd, Jr., Joseph S. Bracewell, Mark C. Michael, Robert L. Orndorff, and Daniel J. Schrider. Joe R. Reeder is nominated to Class II for a two-year term expiring in 2020, and Shaza L. Andersen is nominated to Class III for a one-year term expiring in 2019. All of these nominees currently serve on the board, and Mr. Boyd, Mr. Orndorff, and Mr. Schrider have been elected previously by the shareholders.

Nomination Process

The Nominating Committee is responsible for recruiting and recommending candidates to the board. In exercising its duties, the committee considers the present skills and experience on the board and the qualifications that are desired in order to meet the Company’s changing needs.

Our Corporate Governance Policy outlines the general competencies required of all directors including the highest standards in exercising his or her duty of loyalty, care and commitment to all of our shareholders. Prior to the recruitment of a new director the board gathers input from all directors in order to form a collective picture of the particular competencies needed to fulfill the board’s obligations and support our long-term strategy. Such competencies may include expertise in: the banking industry, financial matters, risk management, marketing, a geographic market, regional economics, strategic planning, executive management, technology or other relevant qualifications. The board also values diversity and seeks to include a broad range of backgrounds, experience and personality styles.

The Nominating Committee encourages suggestions for qualified director candidates from the chief executive officer, the chairman of the board, other directors, and from shareholders, and is responsible for the evaluation of such suggestions. Shareholders may submit suggestions for qualified director candidates by writing to Ronald E. Kuykendall, General Counsel and Secretary, at Sandy Spring Bancorp, Inc., 17801 Georgia Avenue, Olney, Maryland 20832. Submissions should include information regarding a candidate's background, qualifications, experience and willingness to serve as a director. In addition, the Nominating Committee may consider candidates submitted by a third party search firm hired for this purpose. The Nominating Committee uses the same process for evaluating all nominees, including those recommended by shareholders, using the board membership criteria described above. Please see "Shareholder Proposals and Communications" on page 42.

Information About Nominees and Incumbent Directors

The information below sets forth the names of the nominees for election describing their skills, experience and qualifications for election. Each has given his or her consent to be nominated and has agreed to serve, if elected. If any person nominated by the board of directors is unable to stand for election, the shares represented by proxies may be voted for the election of such other person or persons as the present board of directors may designate.

Also provided is information on the background, skills, and experience of the remaining incumbent directors. Unless described otherwise, each director has held his or her current occupation for at least five years, and the ages listed are as of the Record Date.

Voting Standard for Uncontested Elections

With respect to the election of directors, a plurality of all the votes cast at the annual meeting will be sufficient to elect a nominee as a director. In an uncontested election, an incumbent director-nominee who receives a greater number of votes “withheld” than votes “for” shall promptly tender his or her resignation following certification of the shareholder vote. The Nominating Committee shall consider the resignation taking into consideration any information it deems to be appropriate and relevant and make a recommendation to the board.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" EACH OF THE NOMINEES NAMED BELOW AS A DIRECTOR OF SANDY SPRING BANCORP, INC.

Class I Director-Nominees – For Terms To Expire at the 2021 Annual Meeting

|

|

|

|

|

|

|

|

|

|

|

|

Class II Director-Nominee – For Term To Expire at the 2020 Annual Meeting

|

|

Class III Director-Nominee – For Term To Expire at the 2019 Annual Meeting

|

|

Incumbent Class II Directors - Terms Expiring at the 2020 Annual Meeting

|

|

|

| |

|

| |

|

|

Incumbent Class III Directors - Terms Expiring at the 2019 Annual Meeting

|

|

|

|

|

|

|

|

Corporate Governance and Other Matters

The board remains committed to setting a tone of the highest ethical standards and performance for our management, officers, and the Company as a whole. The board believes that strong corporate governance practices are a critical element of doing business today. To that end, the Corporate Governance Policy is reviewed regularly to ensure that it reflects the best interests of the Company and its shareholders. The policy may be found on our investor relations website atwww.sandyspringbank.com.

In addition, our board of directors has adopted a Code of Business Conduct (“Code”) applicable to all directors, officers, and employees of the Company and its subsidiaries. It sets forth the legal and ethical standards that govern the conduct of business performed by the Company and its subsidiaries. The Code is intended to meet the requirements of Section 406 of the Sarbanes-Oxley Act of 2002, related SEC regulations, and the listing rules of Nasdaq Stock Market, Inc. The Code of Business Conduct may be found on our investor relations website atwww.sandyspringbank.com.

The board of directors has affirmatively determined that all directors other than Mr. Schrider and Ms. Andersen are independent. In conjunction with the acquisition of WashingtonFirst, and effective as of December 29, 2017, the Company entered into a separation and consulting agreement with Shaza L. Andersen setting forth her entitlements under her employment agreement with WashingtonFirst in connection with her termination of employment with WashingtonFirst and her service as a non-employee director of and consultant to the Company. The separation and consulting agreement provides for a consulting period of 12 months and a consulting fee of $18,333.33 per month. The agreement was filed as an exhibit to Form 8-K on January 2, 2018.

The board complies with or exceeds the independence requirements for the board and board committees established by the Nasdaq Stock Market, federal securities and banking laws and the additional standards included in our Corporate Governance Policy.

Plurality Plus Resignation Policy

In response to feedback from our shareholder engagement efforts, the board revised the Corporate Governance Policy in 2017 to require an incumbent director to promptly submit a letter of resignation if he or she receives more “withhold” votes than “for” votes in an uncontested election at an annual meeting of shareholders. The resignation will be considered by the Nominating Committee, which will make a recommendation to the board.

Board Leadership Structure, Education and Self-Assessment Process

The Company’s bylaws provide for the annual election of a chairman of the board from among the directors, and the Corporate Governance Policy states it is the board’s policy to separate the offices of the chairman and the chief executive officer. This separate role allows the chairman to maintain independence in the oversight of management. The chairman of the board also chairs the Executive and Governance Committee (see Executive and Governance Committee description below), that is empowered to act on behalf of the board between regular board meetings.

The board is committed to self-improvement and has established an annual self-assessment process that evaluates a different aspect of board effectiveness each year. In 2017, that process was facilitated by The Center for Board Excellence (“CBE”), an independent consultant. All directors completed an assessment of individual director performance. The results of the evaluation were compiled by CBE, and a written report was given to the chairman. The chairman discussed the results with each director confidentially.

Board’s Role in Risk Oversight

The board fulfills a significant role in the oversight of risk in the Company both through the actions of the board as a whole and those of its committees. The board’s Risk Committee has duties and responsibilities for broad risk oversight. The Risk Committee receives regular reports on: credit risk, asset quality, the adequacy of the allowance for loan losses, investment risk profiles, interest rate risk, liquidity, capital adequacy, cybersecurity, vendor management, corporate insurance, litigation management and regulatory compliance. The Compensation Committee reviews reports on risk to the Company associated with incentive compensation plans. The Audit Committee meets regularly with the independent registered public accounting firm to receive reports on the results of the audit and review process. In addition, the Audit Committee receives internal audit reports that enable it to monitor operational risk throughout the Company and coordinates the findings with the Risk Committee through a liaison member who serves on both committees.

The board of directors has the following standing committees: Audit, Executive and Governance, Nominating, Compensation, and Risk. The charter for each committee may be found on our investor relations website atwww.sandyspringbank.com. Each committee’s function is described as follows:

Audit Committee - The Audit Committee is appointed by the board to assist in monitoring: 1) the integrity of the financial statements and financial reporting, including the proper operation of internal control over financial reporting and disclosure controls and procedures in accordance with the Sarbanes-Oxley Act of 2002; 2) compliance with legal and regulatory requirements; and 3) the independence and performance of internal and external auditors. The Audit Committee is directly responsible for the appointment and oversight of the external auditor, including review of their qualifications and compensation. The Audit Committee reviews the quarterly earnings press releases, as well as the Forms 10-Q and 10-K prior to filing. All members of the committee meet all requirements and independence standards as defined in applicable law, regulations of the SEC, Nasdaq listing rules, the Federal Deposit Insurance Act and related regulations. The board has determined that Pamela A. Little qualifies as an audit committee financial expert under the Nasdaq listing rules and applicable securities regulations.

Executive and Governance Committee - This committee conducts board business between regular meetings as needed and provides oversight and guidance to the board of directors to ensure that the structure, policies, and processes of the board and its committees facilitate the effective exercise of the board's role in governing the Company. The committee reviews and evaluates the policies and practices with respect to the size, composition, independence and functioning of the board and its committees as stated in the Corporate Governance Policy. This committee is also responsible for maintaining the Code of Business Conduct, the annual CEO evaluation process, and the annual board evaluation process.

Nominating Committee - Members of this committee are independent directors within the meaning of the Nasdaq listing rules. The Nominating Committee makes recommendations to the board with respect to nominees for election as directors. In exercising its responsibilities, the Nominating Committee considers general criteria and particular goals and needs of the Company for additional competencies or characteristics. The committee also has the authority to engage an outside search firm to source qualified candidates. See page 5 for a discussion of the nomination process.

Compensation Committee – Members of this committee are independent directors within the meaning of the Nasdaq listing rules. The Compensation Committee is responsible for developing executive compensation philosophy and determining all elements of compensation for executive officers including base salaries, short-term incentive compensation, equity awards, and retirement benefits. In addition, the committee considers other compensation and benefit plans on behalf of the board as required by regulation. The committee is charged with assessing whether the compensation plans encourage or reward unnecessary or excessive risk-taking by participants. The committee is also responsible for reviewing and making recommendations for non-employee director compensation and administering the Company’s equity compensation plans.

Risk Committee – The Risk Committee is responsible for assisting the board in its oversight of the Company’s enterprise risk management, including the review and approval of significant policies and practices concerning the various risks described in its charter as well as the analysis and assessment of potential risk in order to make recommendations to the board on strategic initiatives. The board delegates to the Risk Committee the oversight of specific risks as mandated by law or regulation, the authority to manage the Company’s affairs with regard to risk and the authority to handle unresolved issues referred to it by the board for further deliberation and recommendation.

Current Board Committee Membership and Number of Meetings

| Name | Executive & Governance | Nominating | Audit | Compensation | Risk | |||||

| Number of meetings in 2017 | 5 | 2 | 8(1) | 7 | 6 | |||||

| Mona Abutaleb | X | X | ||||||||

| Shaza L. Andersen | X | |||||||||

| Ralph F. Boyd, Jr. | X | X | Chair | |||||||

| Joseph S. Bracewell | X | |||||||||

| Mark E. Friis | X | X | ||||||||

| Robert E. Henel, Jr. | X | X | Chair | |||||||

| Pamela A. Little | X | X | Chair | |||||||

| James J. Maiwurm | X | X | ||||||||

| Mark C. Michael | ||||||||||

| Gary G. Nakamoto | X | |||||||||

| Robert L. Orndorff(2) | Chair | X | X | X | X | |||||

| Joe R. Reeder | ||||||||||

| Craig A. Ruppert | X | Chair | ||||||||

| Daniel J. Schrider | X | X | ||||||||

| Dennis A. Starliper | X |

(1) The Audit Committee met four times in person, and four times by teleconference to approve quarterly earnings releases.

(2)As chairman of the board, Mr. Orndorff is an ex officio member of all committees.

Director Attendance at Board and Committee Meetings

Each of our directors takes his and her commitment to serve on the board very seriously as demonstrated by the superior attendance record achieved each year. During 2017, the board held 10 meetings with overall attendance averaging 96%. In accordance with the Corporate Governance Policy, all incumbent directors attended well over 80% of the aggregate of (a) the total number of meetings of the board of directors and (b) the total number of meetings held by all committees on which they served.

Attendance at the Annual Meeting of Shareholders

The board of directors believes it is important for all directors to attend the annual meeting of shareholders to show support for the Company and to provide an opportunity to interact with shareholders directly. It is our policy that directors should attend the annual meeting of shareholders unless unable to attend by reason of personal or family illness or other urgent matters. All of our directors were in attendance at the 2017 annual meeting.

Cash Compensation

Only non-employee directors are compensated for their service as board members. The Compensation Committee is responsible for reviewing director compensation and will periodically commission a market comparison to ensure compensation levels are appropriate and commensurate with peer companies. Such an analysis was last completed in 2016. As a result annual retainers for directors were increased.

In 2017, the chairman received an annual cash retainer of $52,000, and each non-employee director received an annual cash retainer of $25,000. The committee chairmen received an additional annual cash retainer as follows: Audit Committee $9,000; Compensation Committee $7,000; Executive and Governance $5,000; Nominating Committee $5,000; and Risk Committee $5,000. Board meeting attendance fees were fixed at $1,200 per board meeting and $1,000 per committee meeting.

Directors are encouraged to attend all meetings in person unless the meeting is called by teleconference. Directors who attended a regular board meeting by phone were paid a reduced meeting fee of $500. Directors were not paid for limited-purpose teleconference meetings, and members of the Nominating Committee were not paid when the Executive & Governance Committee met on the same day. All directors of the Company also serve as directors of Sandy Spring Bank, for which they did not receive any additional compensation.

Equity Compensation

On March 15, 2017, each director received a grant of restricted stock valued at $25,000 of Company common stock. The restricted stock will vest over three years in equal increments, and vesting is accelerated upon the permanent departure from the board other than removal for just cause.

Director Fee Deferral Plan

Directors are eligible to defer all or a portion of their fees under the Director Fee Deferral Plan. The amounts deferred accrue interest at 120% of the long-term Applicable Federal Rate, which is not considered “above market” or preferential. Except in the case of death or financial emergency, deferred fees and accrued interest are payable only following termination of a director's service. In the event a director dies during active service, the Bank will pay benefits that exceed deferred fees and accrued interest to the extent the Bank owns an insurance policy in effect on the director’s life at the time of death that pays a greater amount than the total of deferred fees and accrued interest.

Director Stock Purchase Plan

Each director has the option of using from 50% to 100% of his or her annual retainer fee to purchase newly issued common stock at the current fair market value at the time the retainer is paid in accordance with the plan. Directors make an annual election to participate in advance, and participation in the plan is ratified by the board.

2017 Non-Employee Director Compensation

| Fees Earned or | All Other | |||||||||||||||

| Paid in Cash | Stock Awards | Compensation | Total | |||||||||||||

| Name | (1) | (2) | (3) | |||||||||||||

| Mona Abutaleb | $ | 43,400 | $ | 25,000 | $ | 1,169 | $ | 69,569 | ||||||||

| Ralph F. Boyd, Jr. | $ | 48,400 | $ | 25,000 | $ | 1,670 | $ | 75,070 | ||||||||

| Mark E. Friis | $ | 46,000 | $ | 25,000 | $ | 1,670 | $ | 72,670 | ||||||||

| Susan D. Goff | $ | 41,000 | $ | 25,000 | $ | 1,670 | $ | 67,670 | ||||||||

| Robert E. Henel, Jr. | $ | 54,000 | $ | 25,000 | $ | 1,670 | $ | 80,670 | ||||||||

| Pamela A. Little | $ | 56,000 | $ | 25,000 | $ | 1,670 | $ | 82,670 | ||||||||

| James J. Maiwurm | $ | 43,800 | $ | 25,000 | $ | 1,169 | $ | 69,969 | ||||||||

| Gary G. Nakamoto | $ | 43,200 | $ | 25,000 | $ | 1,670 | $ | 69,870 | ||||||||

| Robert L. Orndorff | $ | 88,000 | $ | 25,000 | $ | 1,670 | $ | 114,670 | ||||||||

| Craig A. Ruppert | $ | 47,000 | $ | 25,000 | $ | 1,670 | $ | 73,670 | ||||||||

| Dennis A. Starliper | $ | 45,000 | $ | 25,000 | $ | 1,670 | $ | 71,670 | ||||||||

Stock Ownership Requirements for Directors

According to the Company’s bylaws, qualified directors are required to hold unencumbered shares of common stock with a fair market value of $1,000. The Corporate Governance Policy requires this minimum ownership position to increase with each year of service up to the lesser of 5,000 shares or $175,000 in fair market value by January 1st following the director’s fifth anniversary of service. All of the directors exceed the requirements of the policy.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires that executive officers and directors, and any persons who own more than ten percent of a registered class of the Company’s equity securities file reports of ownership and changes in ownership with the SEC. Specific dates for such filings have been established by the SEC, and the Company is required to report in this proxy statement any failure to file reports in a timely manner in 2017. Based solely on the review of the copies of forms it has received and the written representation from each person, all the executive officers and directors have complied with filing requirements applicable to them with respect to transactions during 2017.

Stock Ownership of Certain Beneficial Owners

The following table sets forth information as of February 8, 2018,August 31, 2020, with respect to the shares of common stock beneficially owned by each director, and director-nominee, by the 20172019 named executive officers, and by all directors and executive officers as a group. No individual holds more than 1% of the total outstanding shares of common stock. All directors and executive officers as a group own 3.31%3.04% of outstanding common stock.

| Name | Shares Owned (1) (2) | Restricted Stock | Shares That May (3) | Total | ||||||||||||

| Mona Abutaleb | 948 | 1,196 | - | 2,144 | ||||||||||||

| Shaza L. Andersen | 77,344 | - | - | 77,344 | ||||||||||||

| Ralph F. Boyd, Jr. | 3,467 | 1,514 | - | 4,981 | ||||||||||||

| Joseph S. Bracewell(4) | 308,741 | - | - | 308,741 | ||||||||||||

| Mark E. Friis(5) | 35,193 | 1,514 | - | 36,707 | ||||||||||||

| Robert E. Henel, Jr. | 8,903 | 1,514 | - | 10,417 | ||||||||||||

| Pamela A. Little | 19,714 | 1,514 | - | 21,228 | ||||||||||||

| James J. Maiwurm | 1,577 | 1,196 | - | 2,773 | ||||||||||||

| Mark C. Michael(6) | 103,405 | - | - | 103,405 | ||||||||||||

| Gary G. Nakamoto | 5,572 | 1,514 | - | 7,086 | ||||||||||||

| Robert L. Orndorff | 164,765 | 1,514 | - | 166,279 | ||||||||||||

| Joe R. Reeder | 55,767 | - | - | 55,767 | ||||||||||||

| Craig A. Ruppert | 77,954 | 1,514 | - | 79,468 | ||||||||||||

| Dennis A. Starliper | 9,168 | 1,514 | - | 10,682 | ||||||||||||

| Daniel J. Schrider(7) | 60,498 | 30,537 | - | 91,035 | ||||||||||||

| Philip J. Mantua(8) | 38,884 | 13,698 | - | 52,582 | ||||||||||||

| Joseph J. O’Brien(9) | 30,079 | 14,772 | - | 44,851 | ||||||||||||

| R. Louis Caceres | 20,819 | 13,841 | - | 34,660 | ||||||||||||

| Ronald E. Kuykendall(10) | 25,467 | 10,119 | - | 35,586 | ||||||||||||

| All directors and all executive officers as a group (21 persons) | 1,061,506 | 115,352 | 1,341 | 1,178,199 | ||||||||||||

| Name | Shares Owned (1) (2) | Restricted Stock | Stock Options | Total | ||||||||||||

| Mona Abutaleb | 3,545 | 885 | - | 4,430 | ||||||||||||

| Ralph F. Boyd, Jr. | 6,087 | 885 | - | 6,972 | ||||||||||||

| Mark E. Friis(3) | 43,483 | 885 | - | 44,368 | ||||||||||||

| Brian J. Lemek | 253,347 | - | - | 253,347 | ||||||||||||

| Pamela A. Little | 25,584 | 885 | - | 26,469 | ||||||||||||

| James J. Maiwurm | 5,645 | 885 | - | 6,530 | ||||||||||||

| Walter Clayton Martz II(4) | 29,902 | - | - | 29,902 | ||||||||||||

| Mark C. Michael | 24,447 | 885 | - | 25,332 | ||||||||||||

| Mark C. Micklem | 12,000 | - | - | 12,000 | ||||||||||||

| Gary G. Nakamoto | 7,936 | 885 | - | 8,821 | ||||||||||||

| Christina B. O’Meara(5) | 44,785 | - | - | 44,785 | ||||||||||||

| Robert L. Orndorff(6) | 167,018 | 885 | - | 167,903 | ||||||||||||

| Craig A. Ruppert | 88,294 | 885 | - | 89,179 | ||||||||||||

| Daniel J. Schrider (7) | 81,180 | 39,724 | - | 120,904 | ||||||||||||

| Philip J. Mantua(8) | 49,230 | 15,521 | - | 64,751 | ||||||||||||

| Joseph J. O’Brien(9) | 42,649 | 18,805 | - | 61,454 | ||||||||||||

| R. Louis Caceres | 29,742 | 14,761 | - | 44,503 | ||||||||||||

| Aaron M. Kaslow | 3,881 | 10,602 | - | 14,483 | ||||||||||||

| Other Executives (4 persons) | 245,098 | 34,627 | 131,683 | 411,408 | ||||||||||||

| All directors and all executive officers as a group (22 persons) | 1,163,853 | 142,005 | 131,683 | 1,437,541 | ||||||||||||

| (1) | Under the rules of the SEC, an individual is considered to "beneficially own" any share of common stock which he or she, directly or indirectly, through any contract, arrangement, understanding, relationship, or otherwise, has or shares: (a) voting power, which includes the power to vote, or to direct the voting of, such security; and/or (b) investment power, which includes the power to dispose, or to direct the disposition, of such security. |

| (2) | Only whole shares appear in the table. Fractional shares that may arise from participation in the dividend reinvestment plan are not shown. |

| (3) | Includes |

| (4) | Includes 1,639 shares held in an estate for which Mr. Martz is personal representative, and 544 shares held in two trusts for which Mr. Martz is trustee. Mr. Martz has no pecuniary interest these holdings. | |

| (5) | Includes 7,699 shares owned by Ms. O’Meara’s spouse. | |

| (6) | Includes |

| (7) | Mr. Schrider’s shares include |

| (8) | Mr. Mantua’s shares include |

| (9) | Mr. O’Brien’s shares include |

Owners of More than 5% of Sandy Spring Bancorp, Inc. Common Stock

This table lists the beneficial owners of more than 5% of our outstanding common stock.

Name | Amount and Nature of Beneficial Ownership | Percentage of Shares Outstanding as of August 31, 2020 | ||||||

BlackRock, Inc. 55 East 52nd Street, New York, NY 10055 | 4,054,048 | (1) | 8.6 | % | ||||

| Dimensional Fund Advisors LP 6300 Bee Cave Road, Austin, TX 78746 | 2,683,945 | (2) | 5.7 | % | ||||

| Name | Amount and Nature of Beneficial Ownership | Percentage of Shares as of Feb 9, 2018 | ||||||

BlackRock, Inc. 55 East 52nd Street, New York, NY 10022 | 2,594,359 | (1) | 7.3 | % | ||||

| Dimensional Fund Advisors LP 6300 Bee Cave Road, Austin, TX 78746 | 1,852,353 | (2) | 5.2 | % | ||||

| (1) | According to the Schedule 13G/A filed by Blackrock, Inc., with the |

| (2) | According to the Schedule 13G/A filed by Dimensional Fund Advisors LP on February |

TransactionsPROPOSAL 1: Approval of the Sandy Spring Bancorp, Inc.

Employee Stock Purchase Plan, as Amended and Relationships with ManagementRestated

DirectorsWe maintain the Sandy Spring Bancorp, Inc. Employee Stock Purchase Plan, which was most recently amended and officersrestated effective November 1, 2020 (the “ESPP”), subject to Company shareholder approval. The ESPP is a benefit that we make broadly available to our employees that allows them to purchase shares of Company common stock (“Common Stock”) at a discount. The Company has maintained an employee stock purchase plan since 2001. We are asking shareholders to approve the ESPP at the Special Meeting so that we may continue to use the ESPP to assist us in recruiting, retaining and motivating qualified personnel who help us achieve our business goals, including creating long-term value for shareholders. In addition, shareholder approval will continue to qualify the ESPP as an employee stock purchase plan under Section 423 of the Company obtain banking productsInternal Revenue Code of 1986, as amended (“Code”), which affords special tax treatment to plan participants.

Proposed Amendment and servicesRestatement

The Company’s Board adopted the ESPP to be effective November 1, 2020, subject to shareholder approval at the Special Meeting. The proposed amendment and restatement would (i) increase the maximum number of shares of Common Stock remaining available for future issuance under the ESPP by 700,000 shares, (ii) extend the term, which otherwise expires on June 30, 2021, so that the ESPP will continue until terminated by the Board in its discretion, (iii) change the frequency of purchases from Sandy Spring Bankmonthly to quarterly, and (iv) make certain other administrative changes. The purpose of the amendment and restatement is to ensure that we are able to continue to provide all current and new employees interested in participating in the normalESPP with the opportunity to do so.

If shareholders approve this proposal, the total number of shares authorized and ordinary coursereserved for issuance under the ESPP will be 1,000,000 shares. However, if this proposal is not approved by shareholders, the total number of business. Such services may include butshares authorized and reserved for issuance under the current employee stock purchase plan will remain at 300,000, of which approximately 24,472 remain available for issuance as of August 31, 2020, and the plan will expire on June 30, 2021. Based on our current forecasts and estimated participation, if the ESPP is approved, it is anticipated that the ESPP will run out of available shares within approximately seven years. In the event that more shares are required for the ESPP in the future, the prior approval of our shareholders will be required.

As of August 31, 2020, the closing price of our Common Stock on the Nasdaq Stock Market was $23.92 per share.

Background

The Company’s Board first adopted an employee stock purchase plan in 2001. When that plan expired in 2011, it was replaced with the 2011 Employee Stock Purchase Plan. The ESPP amends and restates the existing plan.

Summary of the ESPP

The principal features of the ESPP are summarized below. The following summary of the ESPP does not limitedpurport to deposit accounts, loans, trust services, asset management, and insurance for personal or business needs. These products and services are provided on substantiallybe a complete description of all of the same terms, including interest rates and collateral on loans, as those prevailing atprovisions of the same time for comparable transactions with persons not relatedESPP. It is qualified in its entirety by reference to the Company andcomplete text of the Bank. In the opinion of management, these transactions do not involve more than the normal risk of collectability or present other unfavorable features.ESPP, which has been attached as Appendix A to this proxy statement.

Related party transactions involving executive officers or directors, as defined in Item 404 of SEC Regulation S-K, are subject to review by the board. As required by federal regulations, extensions of credit by the Bank to directors and executive officers are subject to the procedural and financial requirements of Regulation OPurpose. The purpose of the Board of Governors of the Federal Reserve System, which generally require advance approval of such transactions by disinterested directors. Extensions of creditESPP to directors or officersprovide eligible employees of the Company and Bankits participating subsidiaries with a means of acquiring an equity interest in the Company through payroll deductions, to enhance such employees’ sense of participation in the affairs of the Company, and to provide an incentive for continued employment.

Administration. The ESPP is administered by the Compensation Committee of the Board (the “Committee”). The Committee has the full authority to adopt administrative rules and procedures and to interpret the provisions of the ESPP. To carry out the purpose of the ESPP, the Committee has appointed a third-party administrator. The administrator is responsible for executing the procedures established by the Committee and keeping adequate and accurate records for participants. All costs and expenses incurred in plan administration are paid by the Company without charge to participants. Participants are responsible for all costs associated with the shares purchased through the ESPP after the shares are delivered to the participants.

Eligibility and Participation. All employees of the Company and its affiliates are eligible to participate in the ESPP, except those employees who have been employed less than three months, employees who regularly work less than 20 hours per week, employees who customarily work no more than five months per year, and any employee who owns 5% or more of the total combined voting power or value of all classes of stock of the Company. An eligible employee may participate in the ESPP only by means of payroll deductions.

A participant’s right to purchase Common Stock may not accrue at a rate that exceeds $25,000 in fair market value of Common Stock (determined as of the offering date) for each calendar year in which the purchase option is outstanding.

Offering Dates and Offering Periods. Effective November 1, 2020, the ESPP will have a series of consecutive offering periods, each of which will be three months in duration, beginning each February 1st, May 1st, August 1st, and November 1st. The Committee will have the authority to change the duration, frequency, start and end dates of offering periods. The offering date will be the first trading day in an offering period.

Purchase Date. Common Stock will be purchased on the last trading day of each offering period.

Purchase Price. The purchase price of the Common Stock acquired on each purchase date will be 0.85 multiplied by the lesser of (i) the fair market value of a share of Common Stock on the offering date of the offering period or (ii) the fair market value of a share of Common Stock on the purchase date. The number of whole shares of the Common Stock a participant purchases in each offering period is determined by dividing the total amount of the participant’s contributions during that offering period by the purchase price, subject to approval by the disinterested membersapplicable share limits.

Payroll Deductions and Stock Purchases. Each participant may authorize periodic payroll deductions in any multiple of 1% to 10% of their eligible compensation. The accumulated deductions will be applied on each purchase date to purchase shares of Common Stock at the purchase price in effect for that purchase date. For purposes of the Risk Committee perESPP, eligible compensation means gross compensation for the terms of Regulation Orelevant pay period, including overtime pay, but excluding all bonuses, severance pay, extraordinary pay, expense allowances or reimbursements, imputed income, moving expenses and Bank policy. If total exposure to an officer or director exceeds $500,000, extensions of credit to that officer or director are subject to approval by all disinterested directors on the board.

Related party transactions as defined in Item 404 (generally, any financial transactions, arrangements, or relationships, regardless of dollar amount, other than extensions of credit and bank deposits) are subject to review by the independent directors with the affected director not present or voting. Effective as of December 29, 2017, the Company entered into an agreement with Shaza L. Andersen setting forth entitlements under her employment agreement with WashingtonFirstincome in connection with her termination of employment with WashingtonFirst and her service as a non-employee director of and consultant to the Company. This agreement was approved by the board of directors and filed with the SEC as an exhibit to Form 8-K on January 2, 2018.equity-based awards.

Termination of Employment. Termination of a participant’s employment for any reason, including death, disability or retirement, immediately terminates the participant’s participation in the ESPP. In such event, the contributions credited to the participant’s account will be returned without interest.

Withdrawal. A participant may withdraw from the ESPP at any time in accordance with the procedures, and prior to the deadline, specified by the administrator. Once a participant’s request for withdrawal becomes effective, no further payroll deductions will be collected from the participant and any outstanding purchase options will be cancelled. The participant may choose to be refunded accumulated deductions or allow funds to be used to purchase Common Stock on the purchase date. A participant’s withdrawal will be irrevocable and will require the participant to re-enroll in the ESPP in order to purchase shares in subsequent offering periods.

Shareholder Rights. No participant will have any shareholder rights with respect to the shares covered by an option until the shares are actually purchased on the participant’s behalf. Unless otherwise elected by a participant, all dividends paid on shares of Common Stock held in the ESPP will be reinvested.

Holding Period. The Committee may permit or require that shares purchased under the ESPP be deposited in the name of the participant with a broker designated by the Company and may require that the shares be retained with such broker for a specified period of time.

Non-Transferability. Rights to purchase shares may not be assigned or transferred by a participant, except by will or laws of inheritance following a participant’s death.

Adjustments; Certain Transactions. The number of shares that may be purchased pursuant to the ESPP is subject to adjustment in the event of a change in Common Stock as a result of a stock dividend or split, recapitalization, merger, consolidation, combination or exchange of shares or other similar change. Upon any such event, the maximum number of shares that may be subject to any option, the number and purchase price of shares subject to options outstanding under the ESPP, and/or the consideration to be received upon exercise of each option will be appropriately adjusted by the Committee. In the event of a merger, consolidation, or certain other corporate transactions, each outstanding purchase option will be assumed or an equivalent purchase option substituted by the successor corporation. If the successor corporation refuses to assume or substitute the purchase option, the offering period with respect to outstanding purchase options will be shortened by setting a purchase date prior to the date of the corporate transaction.

Amendment and Termination. The Committee may, in its sole discretion, amend, suspend or terminate the ESPP at any time and for any reason. If the ESPP is terminated, the Committee may elect to terminate all outstanding offering periods either immediately or once shares of Common Stock have been purchased on the next purchase date (which may, in the discretion of the Committee, be accelerated) or permit offering periods to expire in accordance with their terms.

New Plan Benefits

The benefits to be received by executive officers and employees of the Company and its affiliates as a result of the proposed ESPP are not determinable, since the amounts of future purchases by participants are based on elective contributions.

For illustrative purposes only, the following table sets forth: (i) the number of shares that were purchased in 2019 under the existing employee stock purchase plan and (ii) the weighted average price per share paid for such shares by the current executive officers as a group and all other employees who participated in the plan as a group. Non-employee directors are not eligible to participate in the ESPP.

| Number of Shares Purchased (#) | Weighted Average Purchase Price per Share ($) | |||||||

| All current executive officers as a group (9 persons) | 1,018 | $ | 28.85 | |||||

| All other employees (including all current officers who are not executive officers) as a group | 36,811 | $ | 29.07 | |||||

Summary of U.S. Federal Income Tax Consequences

The following is a brief summary of the effect of U.S. federal income taxation upon the participant and the Company with respect to the shares purchased under the ESPP. This summary does not purport to be complete, and does not discuss the income tax laws of any state or foreign country in which the participant may reside or the gift, estate or any tax law other than U.S. federal income tax law. Because individual circumstances may vary, the Company advises all participants to consult their own tax advisor with respect to the tax implications of participation in the ESPP.

The ESPP is intended to be an employee stock purchase plan within the meaning of Section 423 of the Code. Under an employee stock purchase plan that qualifies under Section 423 of the Code, no taxable income will be recognized by a participant, and no deductions will be allowable to the Company, upon either the grant or the exercise of the purchase option. Taxable income will not be recognized until there is a sale or other disposition of the shares acquired under the ESPP or in the event the participant should die while still owning the purchased shares.

If the participant sells or otherwise disposes of the purchased shares within two years after the start date of the offering period in which the shares were acquired or within one year after the actual purchase date of those shares, then the participant generally will recognize ordinary income in the year of sale or disposition equal to the amount by which the fair market value of the shares on the purchase date exceeded the purchase price paid for those shares, and the Company will be entitled to an income tax deduction, for the taxable year in which such disposition occurs in an amount equal to such excess. The amount of this ordinary income will be added to the participant’s basis in the shares, and any resulting gain or loss recognized upon the sale or disposition will be a capital gain or loss. If the shares have been held for more than one year since the date of purchase, the gain or loss will be long-term.

If the participant sells or disposes of the purchased shares more than two years after the start date of the offering period in which the shares were acquired and more than one year after the actual purchase date of those shares, then the participant generally will recognize ordinary income in the year of sale or disposition equal to the lesser of (a) the amount by which the fair market value of the shares on the sale or disposition date exceeded the purchase price paid for those shares, or (b) 15% of the fair market value of the shares on the start date of that offering period. Any additional gain upon the disposition will be taxed as a long-term capital gain. Alternatively, if the fair market value of the shares on the date of the sale or disposition is less than the purchase price, there will be no ordinary income and any loss recognized will be a long-term capital loss. The Company will not be entitled to an income tax deduction with respect to such disposition.

If the participant still owns the purchased shares at the time of death, the lesser of (i) the amount by which the fair market value of the shares on the date of death exceeds the purchase price or (ii) 15% of the fair market value of the shares on the start date of the offering period in which those shares were acquired will constitute ordinary income in the year of death.

Vote Required and Board of Directors’ Recommendation

Approval of this proposal requires the affirmative vote of a majority of the votes cast. Abstentions and broker non-votes will have no effect on the outcome of the vote.

The Board of Directors recommends a vote “FOR” the approval of the Sandy Spring Bancorp, Inc.

Employee Stock Purchase Plan, as Amended and Restated

Executive Compensation Discussion and Analysis

The following compensation discussion and analysis is intended to provide shareholders with(“CD&A”) provides a detailed description of the Company’s executive compensation philosophy, components, and the factors used by the Compensation Committee (or “committee” within this section) for determining executive2019 compensation for the Company’s named executive officers, as identified by the Company pursuant to the rules of the Securities and Exchange Commission. This discussion should be read in conjunction with the compensation tables and accompanying narrative that can be found starting on page 28.19. For 2017,2019, the named executive officers were:

| Daniel J. Schrider | President, Chief Executive Officer | |

| Philip J. Mantua | EVP, Chief Financial Officer | |

| Joseph J. O’Brien, Jr. | EVP, Chief Banking Officer | |

| R. Louis Caceres | EVP, Wealth Management, Insurance, Mortgage, and Private Banking | |

| EVP, General Counsel |

The executive compensation programSandy Spring Bancorp, Inc. (the “Company”) is designed to be consistent withheadquartered in the suburban Washington, D.C. town of Olney, Maryland and is the holding company for Sandy Spring Bank, a premier community bank in the greater D.C. region. With over 60 locations in Maryland, Virginia, and the District of Columbia, we offer a broad range of commercial and retail banking services, mortgages, private banking, and trust services throughout central Maryland, Northern Virginia, and the District of Columbia. Through our compensation philosophy, to support long-term growth, to reward performance,subsidiaries Sandy Spring Insurance Corporation, West Financial Services, Inc., and to be competitive among our peers.Rembert Pendleton Jackson, we also offer a comprehensive array of insurance and wealth management services.

2019 was the fifth consecutive year of record earnings for the Company Performance Highlightsand included many important strategic events. Net income for the year was $116.4 million, or $3.25 per diluted share, compared to $2.82 million in 2018, a 15% increase. Return on average assets grew to a strong 1.39% from 1.27% in 2018, and return on average tangible common equity increased to 15.68% from 14.60% in 2018. Non-interest income grew 17% in 2019 primarily driven by 107% increase in fees from mortgage banking activity and assisted by a 6.5% increase in wealth management income.

Excellent deposit growth in 2019 improved liquidity, permitted a 38% reduction in wholesale deposits, a 39% reduction in borrowings, and period end growth of 9% compared to the end of 2018. Loan growth was a modest 2% over 2018 as the 7% growth in commercial loans was offset by the sale of mortgage loans and increased mortgage refinance activity. Non-performing loans were 0.62% of total loans as of December 31, demonstrating sound asset quality.

On September 23, 2019, the Company signed a definitive agreement to acquire Revere Bank, a strong in-market commercial bank with $2.8 billion in assets. This transaction closed effective April 1, 2020, bringing the Company’s total assets to approximately $11.8 billion.

On November 6, 2019, the Company reached an agreement to acquire Rembert Pendleton Jackson, an investment and financial advisory firm with an excellent reputation in Northern Virginia. This transaction closed effective February 1, 2020 bringing total assets under management for all wealth management businesses to over $4.5 billion.

Also in the fourth quarter of 2019, the Company successfully issued $175 million in subordinated debt at an advantageous rate. The debt provided capital to support future growth and the redemption of existing higher priced funding sources.

2019 Executive Compensation Elements

The compensation elements for 2019 included base salary, short-term incentive, long-term incentive (equity) and a deferred cash bonus as shown in the following table and described further herein. These elements did not change materially in 2019.

| Description | Objectives | Performance Metrics | |||

| Base Salary | Cash | · | |||

| Annual Incentive | Cash payment based on performance metrics from annual business plan. | · | |||

| performance metrics | · | Return on |

| · |

| Attract and motivate talent | · |

| · | · | Non-interest Income |

| · | |||||

| · | |||||

| Long-term Incentive | Performance-based restricted stock | · | Reward performance over time. | · | Relative 3-year TSR |

| · | Attract and motivate talent | · | EPS Growth | ||

| · | Align with shareholder interests | ||||

| Time-based restricted stock | · | Attract and retain talent | · | 3-year service, pro-rata annual vesting | |

| · | Align with shareholder interests | ||||

| Deferred Cash | Deferred cash bonus based on annual performance | · | Reward superior performance to | · | Relative Return on Average Assets |

| · | Supplement retirement | ||||

| · | Attract and retain talent | ||||

2017 ExecutiveTarget Compensation DecisionsMix

The Compensation Committee began its work on executive compensation for 2017 by reviewing the established compensation philosophy, the Company’s 2016 financial performance and the goals and objectives set forth in the 2017 financial plan. The committee took the following actions:

|

|

“Say On Pay” Vote and Shareholder Alignment

On May 3, 2017,April 24, 2019, shareholders were asked to votevoted on a non-binding resolution to approve the compensation for the named executive officers, commonly referred to as a “Say on Pay” vote. The resolution was approved with an affirmative vote of 96.82%,97% of votes cast, which reflects a strong vote of confidence in our executive compensation program and practices.

The committee consistently utilizes the following practices to ensure executive compensation is aligned with shareholder interests:Executive Compensation Practices

| Yes | No | Avoided Practices | ||

| ü | Independent compensation consultant retained by and | X | No tax gross-ups |

| ü | X | No hedging or pledging of stock |

| ü |

| X | No excessive perquisites |

| ü | X | No “single trigger” severance upon a change-in-control | ||

| ü | Incentive compensation is subject to | X | No encouraging excessive risk-taking | |

| ü | NEOs are subject to stock ownership requirements. | |||

| ü | Annual risk assessment related to executive compensation programs. |

Executive Compensation Philosophy

The Compensation Committee of the board is committed to rewarding executive management for the Company’s performance achieved through planning and execution. Therefore, the committee has developed a philosophy that identifies three guiding principles to properly structure and design elements of executive compensation. In short, executive compensation philosophy has several objectives:should be aligned, balanced, and rewarding.

Aligned - Executive compensation must be aligned with the Company’s strategic objectives, which state that the Company will earn independence by creating franchise and shareholder value. In order to align compensation to this strategy, a significant portion of total compensation is tied to Company performance, both absolute and relative.

Compensation must also be aligned with the competitive markets in order to attract and retain the talent, skills, and experience needed in executive management. The committee works with an independent compensation consultant to receive periodic analyses that benchmark compensation with market trends and practices.

Finally, compensation must align the interests of executives with those of shareholders to ensure that management will be rewarded for increasing shareholder value. To accomplish this, a significant portion of total compensation is in the form of equity.

Balanced - Executive compensation must balance a number of factors. Compensation should have a proper mix of fixed and variable elements, compensation arrangements should use multiple performance measures for balanced achievement, awards should balance short and long-term results with short and long-term career objectives, including retirement, and compensation must always balance risk with reward so as not to encourage excessive risk-taking.

Rewarding - Executive compensation must provide the means to attract, motivate, and retain the caliber of talent and leadership needed to support the Company’s long record of growth and profitability. Compensation arrangements should motivate executives to work collaboratively and creatively to generate a high-level of synergistic performance by and among the officers and employees.

To protect shareholders’ interests, the Committee is also committed to ensuring that rewards are not excessive or paid to the Company’s detriment. Consequently, compensation arrangements incorporate devices such as triggers, thresholds, and maximums, and the board has adopted a “clawback” policy in the event of an accounting restatement. In addition, the committee periodically conducts a risk analysis to ensure that compensation programs do not reward excessive risk-taking.

The committee strives tobelieves this philosophy will ensure the executives have a market-driven level of base compensation and benefits, with the opportunity for significant short and long-term rewards tied to performance and shareholder value. See Elements of Compensation on page 2113 for information on how the committee allocates compensation to further the Company’s compensation philosophy.

Factors for Determining Compensation

Goal Setting for Compensation Purposes

On an annual basis, the board of directorsBoard approves the Company’s annual financial plan. This plan is designed to support a multi-year strategic plan by setting annual targets for achievement that support the long-term objectives expressed in the strategic plan. Once the annual financial plan is approved by the board of directors, theBoard, performance measures and targets for incentive-based compensation are derived from the financial plan. Mr. Schrider and Mr. Mantua report on the Company’s performance to the board of directorsBoard at each regularly scheduled board meeting.

Peer Group Benchmarking

A critical element of the Company’s compensation philosophy is a comparative analysis of the compensation mix and levels relative to a peer group of publicly traded, commercial banks. This analysis is a key driver of specific compensation decisions for the named executive officers and ensures proper alignment between our performance and compensation programs relative to peers, thus enabling the Company to attract and retain executive talent through competitive compensation programs.

Each year the committee reviews the peer group to determine if adjustments are necessary. For 2017,2019, the committee selected publicly-traded commercial banks with assets between approximately $3.0$4 to $8.5$17.0 billion in 2016 and2018 from the Mid-Atlantic region plus Virginia, West Virginia, North Carolina, Massachusetts, and Ohio. The median asset size of the peer group was $4.9$8.2 billion, which placedplacing the Company at the 4855th percentile in asset size at the time.percentile. Peer proxy data was also supplemented with survey data from national banking surveys. The 20172019 peer group included the following 21 banks, of which 1416 were used the previous year:

| Lakeland Bancorp, Inc. | NJ | ||

| MA | NBT Bancorp, Inc. | NY | |

| Community Bank System, Inc. | NY | OceanFirst Financial Corp. | |

| ConnectOne Bancorp, Inc. | NJ | Park National Corporation | OH |

| S&T Bancorp, Inc. | PA | ||

| Tompkins Financial Corp. | NY | ||

| First | TowneBank | VA | |

| First Commonwealth Financial | Union Bankshares Corporation | VA | |

| First | OH | Wesbanco, Inc. | WV |

| Flushing Financial Corporation | NY | WSFS Financial Corporation | DE |

| Independent Bank Corp. | MA |

Committee Discretion and Final Compensation Decisions

The committee retains the discretion to decrease all forms of incentive payouts based on significant individual or Company performance shortfalls. The committee also retains the discretion to increase awards or consider special awards for significant performance or due to subjective factors, or exclude extraordinary non-recurring results.

After the announcement of the merger with WashingtonFirst on May 16, 2017, Mr. Schrider recommended and For 2019, the committee approved the exclusion of merger costsM&A expenses and expenses related to branch closures when calculating the 2017 annual cash incentive award paid to executives discussed further on page 22. The committee agreed that neither the merger nor the related branch closures were includedimpact of issuing $175 million in subordinated-debt in the formulationcalculation of the target levelsannual short-term incentive, neither of which were contemplated in the corporate goals.2019 financial plan at the time it was approved.

ElementsBase Salary - Base salary is the fundamental element of Compensationexecutive compensation. The committee reviews salaries in March in conjunction with annual performance appraisals for the preceding year. In determining base salaries, the committee considers the executive's qualifications and experience, scope of responsibilities, the goals and objectives established for the executive, and the executive's past performance. The committee seeks to pay a base salary, commensurate with the individual’s experience and performance, at market competitive levels. Mr. Schrider recommended base salaries for executive officers other than himself, and the committee deliberated on Mr. Schrider’s salary. The resulting salary adjustments, shown below, were effective March 25, 2019.